Todd Szahun, Senior Vice President of the Consulting Division at Kantar, states that this year in retail will be remembered for many things, from empty store shelves and the challenges that physical retail faced to the record growth of e-commerce and the rise of last-mile delivery partners.

Consumer behaviour and state government guidelines in response to Covid-19 have fundamentally shifted the way consumers live and shop. While some retailers have posted record quarterly revenue and profits, others have shut their doors for good.

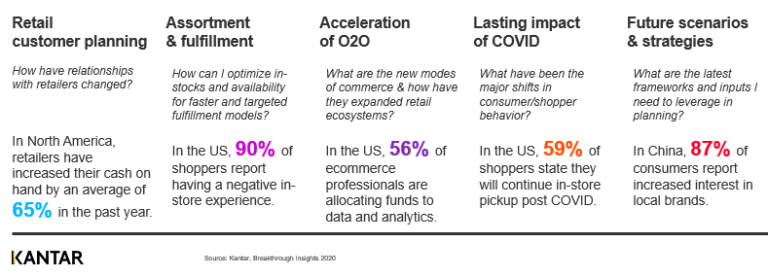

This year’s Breakthrough Insights brings together some of our best thinking of 2020 about the complex ways that all of these changes have and continue to impact manufacturers and retailers. Beyond a point-in-time analysis, these pieces are a guided journey through many of the questions that we heard from respondents through our Covid-19 and Commerce Now series that we grouped into five key themes:

This dynamic collection of work takes the reader from near-term, highly tactical and execution scenarios to more forward-looking, strategic scenario-planning frameworks aimed at maximising organisational agility and preparing companies to excel in a post-pandemic retail environment.

1. Retailers prepare for a downturn

Retailers quickly evolved to address the state of uncertainty, a difficulty in forecasting, and the unprecedented nature of the Covid-19 pandemic. Even though sales increased, many retailers severely cutting back inventory and increased their cash on hand. In this Commerce Now webinar, David Marcotte and Tory Gundelach shared five key metrics to help quantify this pivot and outlined behavioural adjustments that will help you partner with retailers over the next 3-6 months.

Key takeaways:

— Shift mindsets and demonstrate empathy: work with retailers as a business, not just a merchandising location.

— Enhance financial acumen: In 2020, financial knowledge is critical to working in an industry and in countries under great stress.

— Update systems and processes: Review existing systems for potential disconnects between expected and real demand.

— Be proactive to possible portfolio changes: Internally review where you might be exposed to risk if retailers change payment terms and conditions.

Hidden gems of the grocery channel: Covid-19 edition

Hidden Gems series highlights ideas and themes from smaller retailers that Kantar does not track regularly. While these retailers may not be the largest customers, they still provide a deeper view of how the grocery channel is evolving. In this edition, we focused on developments stemming from grocers’ Covid-19 responses.

Key takeaways

— The line between grocers and restaurants will continue to blur: look for more grocers to experiment with curbside meal pickup as well as virtual efforts, like online cooking classes/ demonstrations or even happy hours and tastings, that cater to shoppers’ immediate needs for safety and security but also foster the community spirit found in great restaurant experiences.

— Nontraditional competitors will seek opportunities in grocery’s gains: Discounters and convenience store operators will put more emphasis on food sales to help offset declining sales in more discretionary and fuel-related categories as well.

— More grocers will give seniors special treatment: As boomers mature and the senior population grows, there’s an opportunity beyond COVID-19 for grocers to cater specifically to the ageing population, particularly given that older shoppers will have more spending power as a group than they’ve had historically.

Race, social justice and retail

The resurgence of the Black Lives Matter campaign has put the retail industry in a unique position to respond to social justice issues. We asked shoppers how they want to see retailers react to issues of racial inequality and social justice. This isn’t about how to win the social justice game at retail — listening, understanding and developing a sustainable, custom approach for your business will help you connect with shoppers in ways that go beyond traditional loyalty.

Key takeaways

— There is no one-size-fits-all solution: shoppers care and expect retailers to act, although the strength of those expectations varies by race, generation and location.

— Retailers need to take the time to listen to their shoppers: across the four types of retailer responses, shoppers want to see more actions to support people.

2. Covid-19 purchase behaviour shifts: assortment and portfolio implications

People are shopping differently in the pandemic. Volume and frequency are shifting as shoppers make fewer trips but purchase more in each of those trips. Shopper loyalty is being challenged as shoppers prioritize immediacy and availability over their brand, category, and product preferences. Where shoppers shop is also shifting, with online and omnichannel platforms seeing explosive growth. These new behaviours are driven by a variety of factors: Covid related safety measures that make getting out of the home more difficult, rampant out-of-stocks across categories, and shifting needs as the country spends more time at home.

Key takeaways

— Don’t over-weight pandemic-related trends and behaviours in forecasting and assortment planning.

— Reprioritise niche segments and product variants as shoppers’ preferences re-emerge and their decision-making process becomes less flexible.

— Evaluate lasting shopper preference shifts and seek to understand what behaviours will be sustained post-pandemic.

— Re-evaluate brand loyalty and the competitive set. Understand which brands have gained (and lost) share as shoppers’ consideration sets have expanded.

— Ensure you have the right assortment, content, and strategy for lasting online grocery behaviours.

Crisis inspires new thinking around brand accessibility

With consumers now shopping online and offline for essential items, the biggest concern is not about the channel used, but the ability to get what they need. Collaborations and partnerships that enable rapid access to essentials are providing significant new routes to the consumer. They are alleviating pressure on traditional distribution channels, and also giving new purpose to underutilised stores.

Key Takeaways

— Use high levels of online traffic to better understand the e-commerce customer experience.

— Demonstrate the need for investment to double down on e-commerce and omnichannel capabilities.

— Explore on-demand platforms, taking learnings to finesse distinct solutions post-pandemic.

— Streamline access to products via platforms with high consumer engagement.

3. The state of e-commerce 2021

The great acceleration of e-commerce, fuelled by Americans’ response to Covid-19, has stretched our infrastructure and compressed growth timelines. Evolving shopper behaviour illuminates new priorities for online shopping touchpoints, resets our expectations of shopper convenience over price, and sheds new light on the growing value of social commerce.

The State of Ecommerce 2021 is a landmark study intended to inform new standards of excellence and provide clear calls to action for winning in e-commerce. In order to achieve this, we surveyed 500 online purchasers and 200 industry professionals across brand, shopper marketing, eocommerce, and advertising specialities. Our research unveils powerful insights that will help you execute unique e-commerce strategies across retailers and channels.

Key takeaways

— Unlock custom opportunities with retailers through mutual value: Nearly all of the industry professionals that we spoke with want more cooperation, flexibility, and data from retailers.

— Embrace online grocery and last-mile delivery, even if you aren’t a traditional grocery brand: The unprecedented growth of online grocery and last-mile delivery is an opportunity now that will only get better in the near term.

— Prioritise convenience and ease for shoppers: with new platforms, tools, and data available almost daily, it can be easy to lose sight of the single most important element of a successful e-commerce strategy: the consumer.

4. Post-Covid commerce

The world is experiencing a dynamic and profound shift in the shopping journey. Even without the added layer of the current Covid-19 pandemic, digital commerce has been gaining traction as a preferred method of consumerism. Now, because of the pandemic, we have digitally jumped ahead by three to four years in the span of two months. Pre-pandemic, e-commerce was expected to account for 15% of US sales this year, but by the end of April 2020, 25% of all sales came through e-commerce channels — a 65% jump.

As we consider what the great retail reawakening might look like, we must think about the new shopping habits and how they will impact retailers and branded manufacturers. This post-Covid commerce report examines trends, habits, and implications through four phases of a post-Covid world. We also outline new retailer dynamics, the shopper HOPES strategy and brands’ shopper-centric approach.

Key takeaways

— The new retailer dynamics: capitalise on driving volume through the winners. Retailer profits are facing significant pressure in the assortment and overall investment space. As a supplier, you will need to help and partner with retailers to ensure you are building the right digital assortment and shelf.

— The shopper HOPES strategy: understand that shoppers are scared, hesitant, anxious, worn out and financially challenged. Post-COVID fears will take years to dissipate, especially if the second wave of infections emerges.

— Brands’ omnichannel and shopper-centric approach: E-superiors and e-adaptable will continue to grow and accelerate. If you and your company fall into the e-inferior category as it relates to digital capabilities, now is the time to invest in building competencies.

Gen Z and the Covid-19 implications

Gen Z is changing the cultural conversation on everything from politics to pop music. Despite their young age, members of Gen Z (also known as centennials) are fundamentally health-focused and the most health-minded of any generation today. In this webinar, we discuss the fundamentals of Gen Z and how they differ from previous generations while diving into the near and long-term implications on spending behaviour in the face of the Covid-19 pandemic.

Key takeaways

— Sponsor positive mental health initiatives: consider ways your brand could help younger shoppers improve their mental health states by supporting mental health/stress care and possibly sponsoring associations or in-store seminars/classes.

— Consider how price incentives can reward desired behaviours, such as engagement, health, and sustainability: be transparent with centennials about certain pricing premiums and provide discounts for shipping options that reduce the environmental impact. Expect pricing to be increasingly personalised based on lifestyle data.

— Embrace virtual communication: with centennials’ social life so limited, brands and retailers need to sponsor online platforms that foster social interaction and provide engagement and entertainment for younger consumers.

— Develop a telehealth strategy: align your product with telehealth services that can help meet centennials’ health needs.

To download the report, click here.